ITC FLOW CHART IMS to GSTR-2B and GSTR-3B

ITC FLOW CHART IMS to GSTR-2B and GSTR-3B to Integrating IMS, enhances reconciliation, boosts accuracy and easy processes. The Input Tax Credit (ITC) flow in the GST system plays a crucial role in ensuring compliance and efficient tax management. The seamless integration of an Invoice Management System (IMS) with GSTR-2B and its subsequent flow to GSTR-3B simplifies the reconciliation process and ensures accuracy in tax filings. Below is a step-by-step flowchart explaining how ITC moves through these stages:

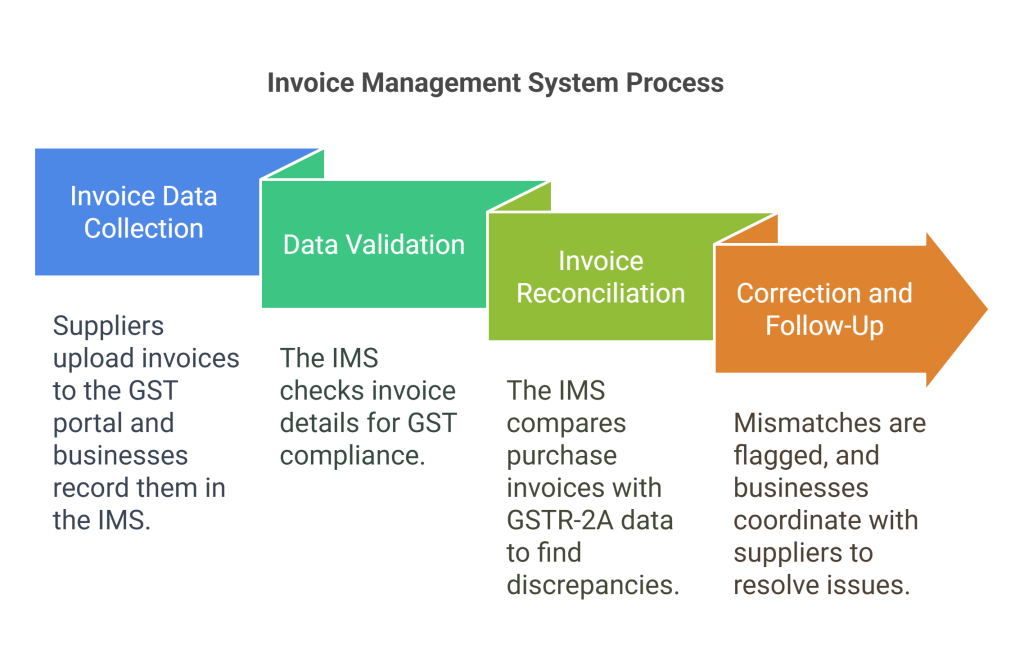

1. IMS (Invoice Management System)

- Invoice Data Collection:

Suppliers upload invoices on the GST portal, and businesses record purchase invoices in the IMS. - Data Validation:

IMS validates the invoices by checking details such as GSTIN, invoice numbers, tax amounts, and compliance with GST rules. - Invoice Reconciliation:

IMS reconciles purchase invoices with supplier-uploaded data from GSTR-2A to identify mismatches and discrepancies. - Correction and Follow-Up:

Mismatched or missing invoices are flagged, and businesses follow up with suppliers to rectify errors or ensure timely filing of returns.

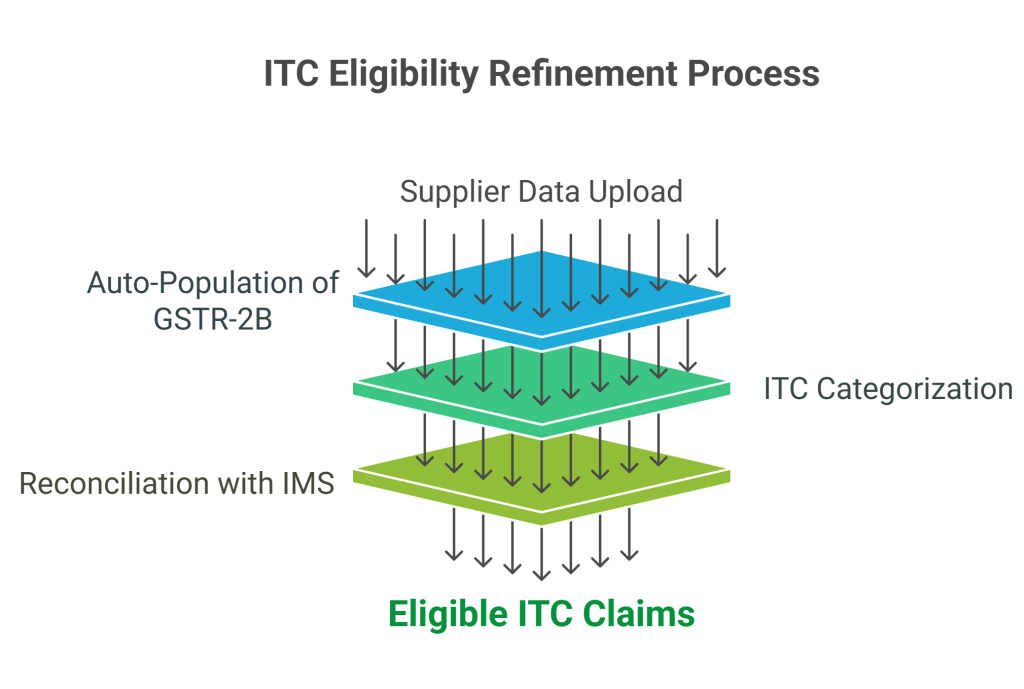

2. GSTR-2B (Static ITC Report)

- Auto-Population of Data:

The GST portal generates GSTR-2B based on supplier-uploaded data in their GSTR-1, GSTR-5, and GSTR-6. It is a static, month-specific report available on the 14th of every month. - Categorization of ITC:

GSTR-2B classifies ITC into two categories:- Available ITC: ITC eligible for claim in GSTR-3B.

- Unavailable ITC: ITC ineligible due to GST non-compliance, incorrect invoices, or mismatches.

- Reconciliation with IMS:

Businesses reconcile GSTR-2B with the purchase register from IMS to ensure only eligible ITC is claimed. Mismatches identified in this stage can be resolved before filing GSTR-3B.

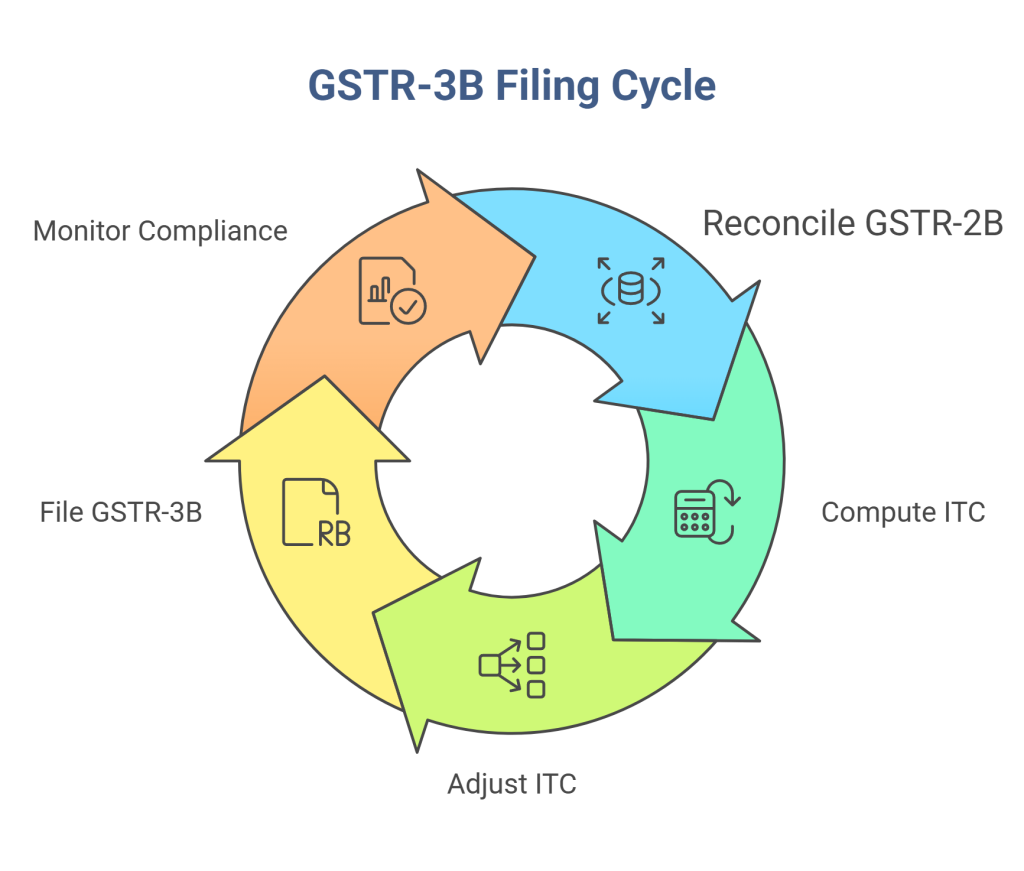

3. GSTR-3B (Monthly Tax Filing)

- Input Tax Credit Claim:

After reconciling GSTR-2B with IMS data, businesses compute the final ITC amount to claim in GSTR-3B. - ITC Adjustment:

Claimed ITC is adjusted against the GST liability. The remaining liability, if any, is paid in cash. - Filing and Submission:

Businesses file GSTR-3B, ensuring accurate reporting of outward and inward supplies, tax liabilities, and claimed ITC. - Compliance Monitoring:

The GST portal validates the data submitted in GSTR-3B with GSTR-2B to ensure compliance and prevent fraudulent claims.

ITC Flow Summary

The Input Tax Credit (ITC) flow in the GST system is a critical process that ensures accurate tax management and compliance for businesses.

- IMS (Invoice Management System): It begins with the Invoice Management System (IMS), a centralized system designed to efficiently manage and reconcile invoices. IMS captures data from supplier invoices, validates the details, and compares them against purchase registers to identify any discrepancies or mismatches. This process ensures that only eligible ITC is claimed, thereby reducing errors and potential compliance issues. Once the invoice data is processed in IMS, it flows into the next phase of the ITC process.

- GSTR-2B: This is an auto-generated report provided by the GST portal. GSTR-2B serves as a static reference document that categorizes ITC into two parts: eligible ITC (available for claim) and ineligible ITC (disallowed due to mismatches or non-compliance). This report pulls information directly from the supplier’s GSTR-1, GSTR-5, or GSTR-6, offering businesses a snapshot of their eligible credit for the month. The static nature of GSTR-2B eliminates the constant updates seen in the older GSTR-2A, making it a reliable reference for finalizing ITC claims.

- GSTR-3B: The final step in the ITC flow is GSTR-3B, the monthly GST return that businesses file to report their ITC claims and tax liabilities. In GSTR-3B, businesses declare the ITC they are eligible to claim based on the data from IMS and GSTR-2B. This return also allows for the adjustment of ITC against the GST liability, ensuring that the net tax payable is accurate. By following this integrated process from IMS to GSTR-2B and then GSTR-3B, businesses ensure accurate tax filings, streamline compliance, and optimize their ITC utilization, ultimately enhancing the efficiency of their overall GST management.

This structured flow ensures transparency, accuracy, and compliance in GST reporting. By leveraging IMS for efficient invoice management and reconciling it with GSTR-2B, businesses can minimize errors, avoid penalties, and maximize ITC utilization.