📌 What is IMS (Invoice Management System)?

WHAT IS IMS (INVOICE MANAGEMENT SYSTEM)? A new GST portal feature enabling taxpayers to manage invoice corrections, amendments & ITC claims efficiently. 🚀

✅ 🌟 Purpose of IMS (Invoice Management System) 🌟

The Invoice Management System (IMS) is designed to streamline the invoice reconciliation process for taxpayers, ensuring accuracy in GST filings and Input Tax Credit (ITC) 🏦 claims. It acts as a structured communication bridge 🌉 between suppliers and recipients, enhancing transparency 🔍 and minimizing tax discrepancies ❌.

✔️ Seamless Invoice Matching 📄

📌 IMS helps taxpayers effortlessly match their invoices with those issued by suppliers.

📌 Ensures that details reported in 📑 GSTR-1 align with the recipient’s records.

📌 Reduces errors ⚠️ in tax filings and compliance issues.

✔️ Ensuring Correct ITC Claims 💰

🏦 Helps taxpayers claim only the correct and eligible ITC.

🛡️ Prevents penalties, interest, and audits 🚫💸 due to mismatched invoices.

✅ Accurate invoice matching before ITC claims in 📊 GSTR-3B.

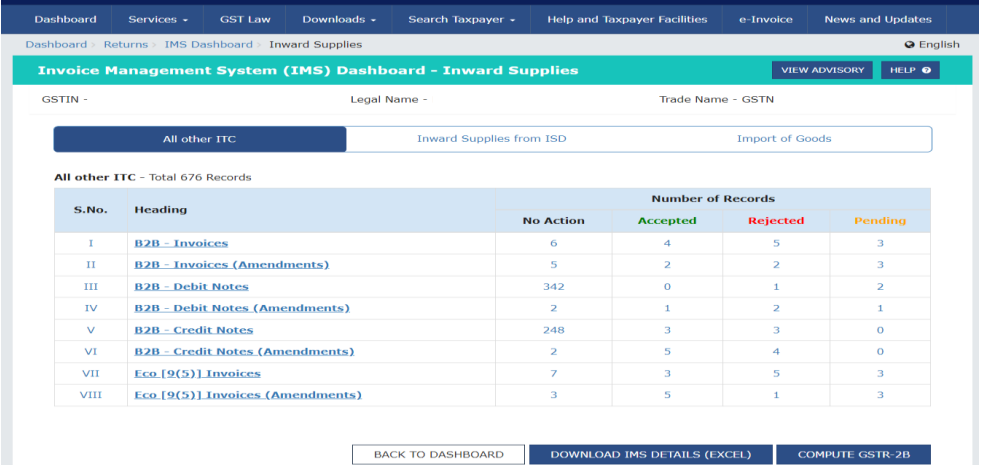

🔄 Action-Based Control: Accept ✅ | Reject ❌ | Pending ⏳

✔️ ✅ Accept: Moves to available ITC in GSTR-2B.

✔️ ❌ Reject: Eliminates incorrect ITC claims.

✔️ ⏳ Keep Pending: Allows future verification before final action.

This system enhances compliance 📜, reduces tax disputes ⚖️, and ensures a smooth GST process 🔄. 🚀

🔄 Flow of IMS:

All outward supplies reported in 📑 GSTR-1 / 🗂️ IFF / 📜 1A will populate in the IMS dashboard for recipients to take action.

🔹 ✅ Accept: Moves to ‘ITC Available’ section of GSTR-2B, and ITC is auto-populated in GSTR-3B.

🔹 ❌ Reject: Moves to ‘ITC Rejected’ section of GSTR-2B. ITC will not be auto-populated in GSTR-3B.

🔹 ⏳ Pending: Stays on IMS dashboard until accepted or rejected. Not included in GSTR-2B or GSTR-3B.

📌 Pending action is NOT allowed for:

🚫 Original Credit Notes

🚫 Upward amendment of Credit Note (regardless of previous action)

🚫 Downward amendment of Credit Note if original was rejected

🚫 Downward amendment of Invoice/Debit Note if original was accepted and GSTR-3B was filed

🔑 Key Points on IMS:

💡 Deemed Accepted: If no action is taken by the time of GSTR-2B generation, the record will be considered as ‘Deemed Accepted’.

📅 Mandatory Recompute: If action is taken after the 14th of the month (GSTR-2B generation date), taxpayers must recompute GSTR-2B from the IMS dashboard.

❌ Supplies that won’t go to IMS but directly to GSTR-3B:

🔹 RCM Supplies (if reported in Table 4B of GSTR-1/IFF)

🔹 Ineligible ITC due to Section 16(4) or POS rule

📌 Records flow to IMS at the time of saving by supplier, but they appear in GSTR-2B only after the supplier files GSTR-1/IFF/1A.

🔄 Accepted / Deemed Accepted / Rejected records move out of IMS after GSTR-3B is filed.

🔄 Pending records stay in IMS and can be accepted or rejected in future months.

📢 Important Compliance Rules:

⚠️ Action on original record must be taken before action on amended record (if different return periods).

⚠️ If a supplier modifies an invoice before filing GSTR-1/IFF, the record status on IMS resets.

⚠️ Sequential GSTR-2B generation: GSTR-3B of the previous period must be filed first!

🔥 Impact on Supplier’s Liability:

📈 Supplier’s liability in GSTR-3B increases for invoices rejected by the recipient in IMS for the following cases:

❌ Original Credit Note rejected

❌ Upward amendment of Credit Note rejected

❌ Downward amendment of Credit Note rejected (if original was rejected earlier)

❌ Downward amendment of Invoice/Debit Note rejected (if original was accepted & GSTR-3B filed)

📌 For More Details: 🔗 Click Here

📸 Below is a screenshot of the IMS dashboard showing a summary of all inward records and actions taken. This IMS Dashboard Button is Visible in Return Section of GST Portal after Login.